The Nation’s #1 Dual Pricing & Surcharging Platform.

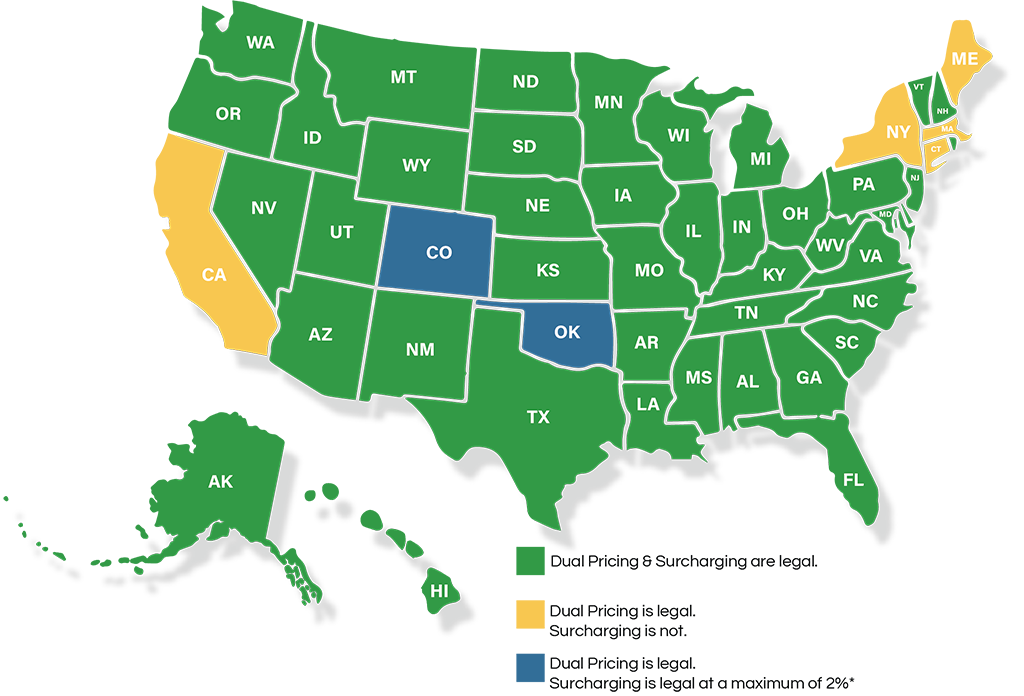

Dual Pricing & Surcharging States

Is Surcharging Legal?

Surcharging

Surcharging is rapidly gaining approval throughout the United States. Originally, there were a total of 10 states that banned surcharging, but as of 2024, only Connecticut, Maine, Massachusetts, California, and New York do not allow merchants to apply a surcharging fee. Colorado and Oklahoma allow merchants to apply a surcharge at a maximum of 2%.

How Does Surcharging Work?

- Signage must be posted at the entrance as well as the Point-of-Sale

- Signage must state:

• Exact amount or percentage of the Surcharge

• Statement that a Surcharge is being assessed by the merchant

• Surcharge is only assessed on credit card transactions

• Surcharge is not greater than the MDR - Merchant must be registered with Mastercard 30 days before processing

- Along with the merchant application, the merchant must also execute the Merchant Attestation

Why Choose Swipe4Free?

Businesses that join Swipe4Free see an immediate increase in profit as a result of the savings from eliminating their processing bill. These savings are being used to cover payroll increases as a result of minimum wage hikes, rent and utility increases, increases in cost of merchandise, and much more.

“My terminal clearly shows the cash price and card price making it easier for me and my customers to see the savings when paying with cash. If a customer purchases $10 worth of goods, I receive $10. This is one amazing service and it’s completely free for merchants!”

“My family’s cost of living was going up and I needed to increase the amount of money I took home.

Swipe4Free allowed me to instantly increase my profits and cover my family’s overhead.”

“Thanks to Swipe4Free. I’m able

to manage higher minimum wage

laws for my employees without

having to reduce their hours or

downsize my staff.”

“Food & labor costs are constantly increasing. Swipe4Free helped us recover those increased costs by eliminating our credit card processing fees instantly.